Construction’s Tech Revolution: New Data Reveals Where the Industry Stands in 2025

AlterSquare July 8, 2025

The construction industry’s relationship with technology has always been complex—balancing innovation with tradition, efficiency with proven methods, and digital possibilities with physical realities. New research from Bluebeam, based on insights from over 400 technology leaders across eight countries, provides the clearest picture yet of where the industry stands on its digital transformation journey.

The findings reveal an industry in transition, with significant progress in some areas but persistent challenges that continue to slow adoption. More importantly, the data shows how financial pressures and competitive dynamics are finally pushing firms to embrace technologies they might have previously considered optional.

AI Adoption Accelerates Despite Regulatory Concerns

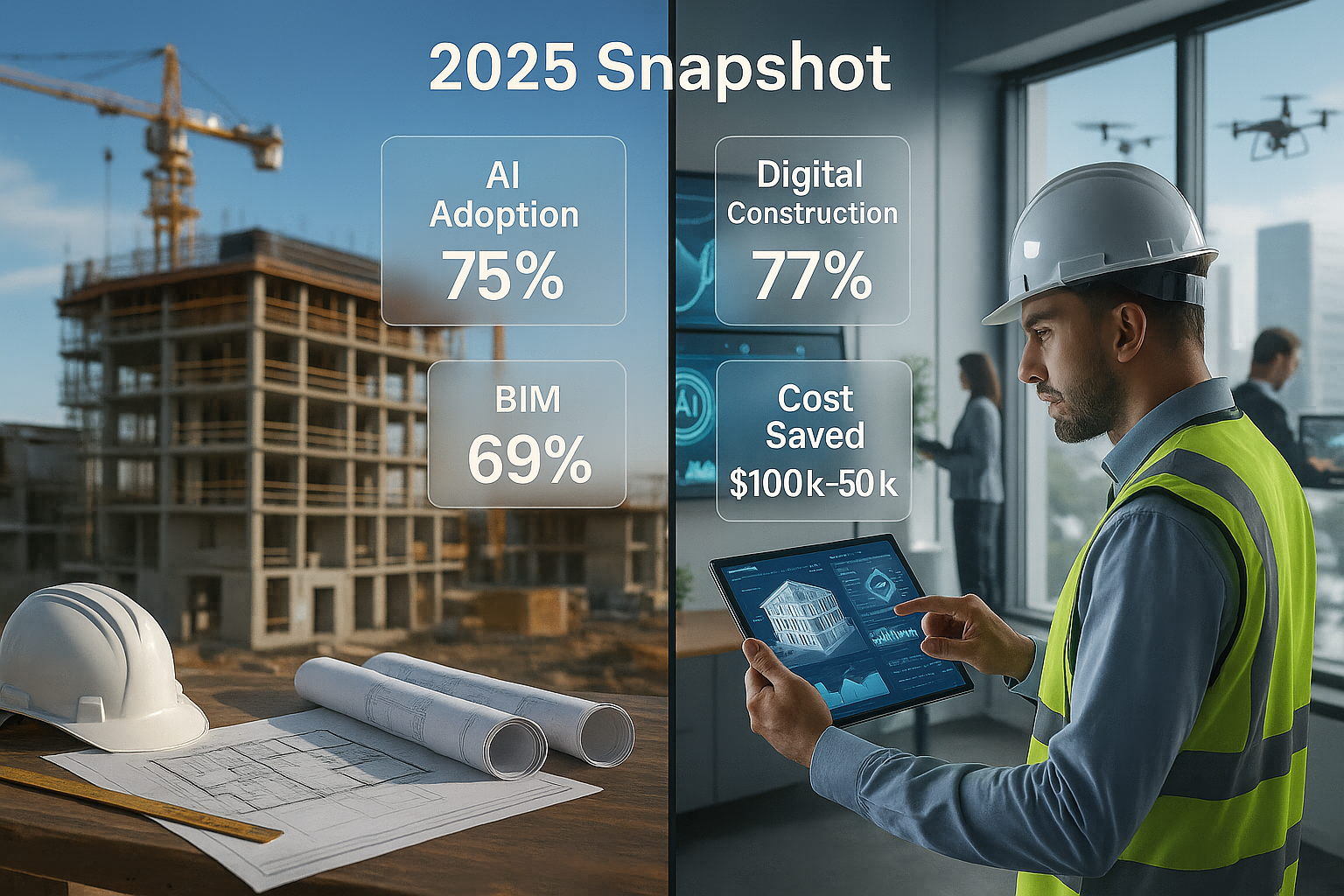

Perhaps the most striking finding is how quickly artificial intelligence has moved from experimental curiosity to practical tool. Three-quarters of surveyed AEC professionals now use AI in at least one phase of their building projects, marking a dramatic shift from just two years ago when AI was barely on most firms’ radar.

The adoption pattern reveals where AI delivers the most immediate value. Design work leads the charge at 48% adoption, followed closely by planning at 42%. This makes intuitive sense—both phases involve complex data analysis, pattern recognition, and optimization challenges where AI excels. Design teams use AI for everything from generating initial concepts to optimizing building performance, while planning teams leverage it for scheduling, resource allocation, and risk assessment.

What’s particularly encouraging is the depth of commitment among early adopters. Over half of companies using AI consider it crucial to their operations, and most now dedicate up to 25% of their technology budgets to AI initiatives. This level of investment suggests firms are moving beyond pilot projects to strategic implementation.

However, regulatory uncertainty casts a shadow over this enthusiasm. More than half of respondents express concerns about AI regulations, with 44% saying these worries directly impact how they use AI technologies. This regulatory hesitation is understandable given the high-stakes nature of construction projects, where AI decisions could affect safety, compliance, and liability.

Despite these concerns, future investment intentions remain strong. An overwhelming 84% of companies expect to increase AI spending over the next five years, suggesting that perceived benefits outweigh regulatory risks for most organizations.

Digital Tools Reach Critical Mass

Beyond AI, the broader digitization picture shows an industry that has largely embraced digital tools, at least in core processes. Digital adoption reaches 77% during both construction and design phases, with planning close behind at 74%. These numbers represent a fundamental shift from the paper-based processes that dominated construction for decades.

Building Information Modeling (BIM) leads the technology adoption rankings at 69%, cementing its position as the backbone of modern construction workflows. This widespread BIM adoption creates a foundation for other digital innovations, since BIM models serve as central data repositories that other tools can access and enhance.

Computer-Aided Design (CAD) at 54% and project management software at 53% round out the top three, representing the core digital toolkit that most firms now consider essential. The convergence of these three technologies—BIM for comprehensive building modeling, CAD for detailed design work, and project management platforms for coordination—creates integrated workflows that were impossible with traditional methods.

The Financial Case for Technology

Perhaps most compelling for skeptical executives are the financial benefits that firms report from technology adoption. Over one-third of companies document cost savings between $100,000 and $500,000 from digital tool implementation. These aren’t theoretical future benefits—they’re measurable savings happening today.

These savings come from multiple sources: reduced rework through better coordination, faster design iterations, improved accuracy in quantity takeoffs, and more efficient project management. The scale of savings helps explain why technology budgets continue growing even in competitive markets where margins remain tight.

The financial benefits extend beyond direct cost savings to include competitive advantages. Firms with advanced digital capabilities can bid more accurately, deliver projects faster, and provide clients with better insights throughout the construction process. These advantages become increasingly important as client expectations rise and project complexity increases.

Persistent Barriers to Full Adoption

Despite significant progress, substantial obstacles remain. The skills gap emerges as the primary challenge, with 32% of respondents citing lack of training as their biggest barrier to digital adoption. This finding highlights a critical mismatch between technology capabilities and workforce readiness.

The skills challenge operates at multiple levels. Many experienced construction professionals learned their trades before digital tools became standard, requiring substantial retraining to achieve fluency with new technologies. Meanwhile, newer professionals often understand digital tools but may lack the construction experience to apply them effectively.

Integration challenges affect 27% of firms, reflecting the complexity of connecting multiple software systems, data formats, and workflows. Construction projects involve numerous stakeholders using different tools, making seamless integration technically challenging and organizationally complex.

Technical issues, reported by 26% of respondents, represent another significant hurdle. These might include software reliability problems, hardware limitations, or connectivity issues that disrupt digital workflows. In an industry where project delays can be extremely costly, technology that doesn’t work reliably can quickly lose credibility.

The Paper Paradox

One of the survey’s most surprising findings is the persistence of paper documentation. Nearly three-quarters of respondents still use physical documents in one or more project phases, despite widespread digital tool adoption. This paper persistence reveals important insights about construction’s unique requirements and resistance points.

The primary driver of continued paper use is regulatory and legal requirements. Almost half of firms cite the need for physical signatures or approvals as their main reason for maintaining paper processes. Many jurisdictions still require physical documentation for permits, inspections, and legal compliance, creating mandatory paper touchpoints even in otherwise digital workflows.

However, this paper persistence also reflects deeper cultural and practical considerations. Many field workers prefer physical documents that don’t require devices, battery power, or network connectivity. Safety-critical information often exists in both digital and physical formats to ensure accessibility during emergencies or equipment failures.

Sustainability: The Next Digital Driver

Sustainability emerges as both a challenge and an opportunity in the survey results. While the sector acknowledges sustainability’s importance, only half of respondents consider their company’s sustainability efforts successful. This gap between intention and achievement suggests significant room for improvement.

Budget allocation reflects this mixed commitment. Most firms dedicate less than 25% of their budgets to sustainability initiatives, with only 27% investing more heavily. However, 50% expect to increase sustainability spending next year, suggesting growing recognition that environmental performance will become increasingly important.

Digital tools offer significant opportunities to improve sustainability outcomes. BIM models can optimize building performance and reduce material waste. AI can identify energy efficiency opportunities and predict maintenance needs. Project management software can track sustainability metrics and ensure compliance with environmental standards.

The connection between digitization and sustainability will likely become a major driver of technology adoption as environmental regulations tighten and client demands for sustainable buildings increase.

Bridging the Skills Gap

The research highlights an urgent need for coordinated action to address technology skills shortages. This challenge requires collaboration between educational institutions, technology providers, and industry organizations to develop training programs that meet real-world needs.

Effective solutions will likely combine formal education with hands-on training, mentorship programs, and continuous learning opportunities. Technology providers must design more intuitive tools that reduce learning curves, while industry organizations need to develop standards and best practices for technology implementation.

The firms that successfully bridge the skills gap will gain significant competitive advantages through better technology utilization, while those that fall behind may struggle to attract talent and win projects in an increasingly digital marketplace.

Looking Forward: Technology as Competitive Advantage

The survey data suggests construction is reaching a tipping point where technology adoption shifts from optional enhancement to competitive necessity. Firms with advanced digital capabilities demonstrate measurable advantages in cost, speed, and quality—advantages that become more pronounced as client expectations evolve.

The next phase of construction technology evolution will likely focus on integration and intelligence. Rather than simply digitizing existing processes, successful firms will redesign workflows around digital capabilities, using AI to optimize decisions, IoT sensors to monitor performance, and cloud platforms to enable real-time collaboration.

Organizations that treat technology as a strategic capability rather than just operational tool will be best positioned to thrive in this evolving landscape. The data shows the transformation is already underway—the question is how quickly individual firms will adapt to remain competitive in construction’s digital future.

Leave a Reply